Introduction

If your business accepts card payments, whether across multiple retail stores or hospitality venues, you’re likely to encounter these issues:

- Fees add up and often feel unclear.

- You’re unsure exactly what you’re paying for.

The Interchange++ pricing model (IC++) offers complete transparency: the interchange fee, the scheme fee, and the acquirer markup are highlighted as three distinct charges.

In this article, we’ll cover:

- Explain what Interchange++ is (and avoid jargon)

- Compare it to blended pricing and explain when each model makes sense

- Show practical steps you can take to benchmark your current contract

- Share more about our services and how we can help multi-site SMEs get control and savings with Interchange++

What is Interchange++ (IC++)?

Put simply: Interchange++ = Interchange fee + Scheme fee + Acquirer markup.

- Interchange fee: The fee set by the issuing bank (the cardholder’s bank).

- Scheme fee: The cost from the card scheme (e.g., Visa, Mastercard) for using their network.

- Acquirer markup: The fee your acquirer (payment provider) charges for managing your account, payment terminal, payment gateway etc.

Ultimately, this pricing model gives you transparency on how the overall cost has been cumulated.

Why this matters

- You can compare providers fairly (apples-to-apples).

- You can spot hidden mark-ups or unexplained increases.

- You gain control over your pricing model.

What is blended pricing?

Blended pricing is the simpler but less transparent model: you pay a single rate for specific card types where the three individual cost elements are blended together (e.g., 0.6% Visa Debit or 1% Mastercard Credit, etc.) on every transaction. This will also typically include an authorisation fee charged as a pence (e.g., 3p) per transaction.

- Easy to understand.

- Vulnerable to frequent inflight price increases.

- May not be the best option for your business: the acquiring bank will have different levels of markup across different card types.

If you process large volumes, have multiple sites, or want to track cost dynamics closely, blended pricing can lock you into paying more than needed.

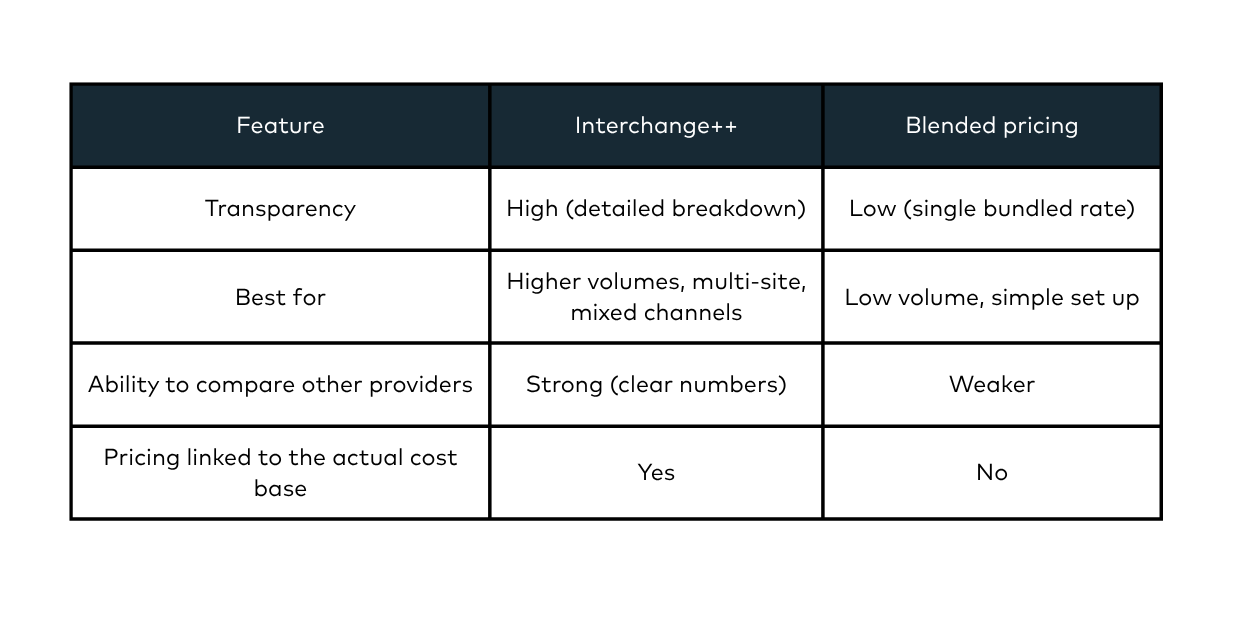

Interchange++ vs Blended: Which model should you pick?

When to choose each pricing model?

Consider Interchange++ when:

- You are a multi-site business, Interchange++ might be a better option.

- You want a contract that is fair, transparent, and lets you benchmark more accurately.

- Your payment volume is high enough that the model can make a meaningful difference.

Stick with Blended pricing when:

- Your business has a small volume of card payments, and the complexity of IC++ is not worth the savings.

- You prefer simplicity and are comfortable with a flat rate, knowing you might pay a little more.

Next steps

This is a great opportunity to get in touch with procurement consultants and request a review of your current payment solution. Industry professionals will guide you through your options and advise on the best available option for your business. At Unyfi, we specialise in supporting businesses to:

- Understand what they’re currently paying

- Move to transparent IC++ pricing if appropriate

- Manage the rollout and offer ongoing support

Whether you are interested in Interchange++ pricing solution, or have a question about your current one, we’re here to help.